Find Your Perfect Business Degree

www.business-management-degree.net is an advertising-supported site. Featured or trusted partner programs and all school search, finder, or match results are for schools that compensate us. This compensation does not influence our school rankings, resource guides, or other editorially-independent information published on this site.

Startup Billionaires are a special breed of entrepreneurs who turn their innovative ideas into something that generates huge profits for them. They are the ones at the top of the startup hierarchy, having made it through the long and often unpredictable process of founding, branding, and scaling a business. They stand as a testament to what can be achieved with ingenuity, hard work, and perseverance.

However, it isn’t just luck that has made them billionaires. Behind each success story is an incredibly impressive set of numbers that provide insight into the components that shaped their business models and allowed them to find success.

By looking at the key numbers of some of the world’s most successful entrepreneurs, we can gain a better understanding of what it takes to succeed in the startup world.

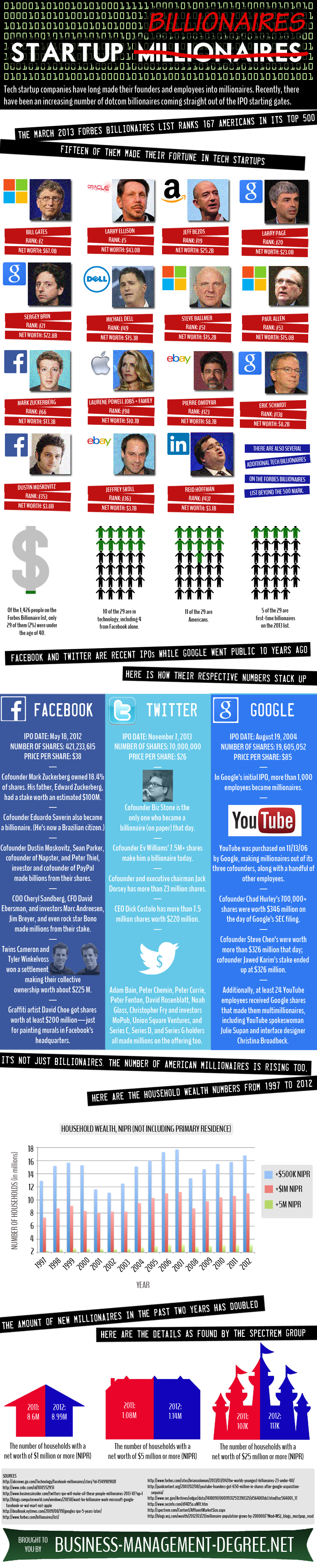

Tech startup companies have long been a source of millionaire founders and employees. In more recent years, there have been tech billionaires out of the IPO starting gate for dotcom companies.

Tech Billionaires

In Forbes (worldwide) Billionaires list, in the top 500 positions (#1-490, due to tied positions), the U.S. had 167 billionaires (those who are American citizens) or about 33%.

In Forbes’ Mar 2013 Billionaires list, the United States has 167 citizens in the top 500 positions (ranking #1-490, due to ties). So about 33% of the top 500 billionaires are Americans. An even smaller number are tech startups. Here are the number of billionaires by company for a selection of recent or one-time tech startups — from the Forbes top 500:

- 1 – Amazon.com: Jeff Bezos (rank #19, $25.2B)

- 1 – Apple.com: Laurene Powell Jobs and family (rank #98, $10.7B: partial fortune from Disney)

- 1 – Dell: Michael Dell (rank #49, $15.3B)

- 2 – Ebay: Pierre Omidyar (rank #123, $8.7B), Jeffrey Skoll (rank #363, $3.7B)

- 3 – Facebook: Mark Zuckerberg (rank #66, $13.3B), Dustin Moskovitz (rank #353, $3.8B). An additional 4 Facebook billionaires ranked beyond 500 (see note #4, below).

- 3 – Google: Larry Page (rank #20, $23B), Sergey Brin (rank #21, $22.8B), Eric Schmidt (rank #58, $8.2B). An additional 3 Google billionaires ranked beyond #500 (see note #5, below).

- 1 – LinkedIn: Reid Hoffman (rank #437, $3.1B)

- 3 – Microsoft: Bill Gates (rank 2, $67B), Steve Ballmer (rank 51, $15.2B), Paul Allen (rank 53, $15B: fortune partly from investments)

- 1 – Oracle: Larry Ellison (rank 5, $43B)

Notes:

- Ranking #s above are from the full worldwide Billionaires list, with net worth calculated by Forbes in Mar 2013.

- Microsoft and Oracle haven’t been startups in decades, but are included for reference.

- There are additional American “tech” billionaires in the full Forbes list from previous decades.

- There are 4 additional billionaires associated with Facebook: Eduardo Saverin (rank #670, $2.2B); Sean Parker (rank #736, $2B: fortune from other sources as well); Peter Thiel, Facebook’s first outside investor, ranked #931 ($1.6B – part of which may be from his stake in co-founding PayPal); Jim Breyer, another investor, was ranked #1175 ($1.2B – part of which is his from his venture capital investments elsewhere).

- There are 3 additional billionaires associated with Google beyond ranking #490 — all early investors: Andreas von Bechtolsheim (rank #503, $2.8B), David Cheriton (rank #882, $1.7B), Kavitark Ram Shriram (rank #922, $1.65B).

- According to the Forbes Billionaires list, there were 1426 people listed in total.

- 29 of the 1426 people (about 2%) were under 40 at the time.

- 10 of the 29 are in technology, which includes 4 from Facebook alone.

- 11 of the 29 are Americans.

- 5 of the 29 are first-time billionaires.

Google vs Facebook vs Twitter

Facebook and Twitter are two of the more notable recent tech startups to go public, with Google going public nearly 10 years previous. Here are some numbers on the collective wealth of these companies.

- Google started trading on Aug 19, 2004, with an IPO share price of $85, but opened at $100.

- Estimates suggested that upon the IPO, at least 1,000 Google employees would become millionaires on paper. Further estimates suggest more than 1,000 employees have since become millionaires.

- YouTube, which was purchased on Nov 13, 2006 by Google for $1.65B, made its founders millionaires, along with a few other employees, at least on paper, since the deal was all-stock only.

- Co-founder Chad Hurley’s stake was estimated to have been worth $345.6M (694,087 Google shares, plus 41,232 shares in trust), based on a market price on of $470.01 on the day of Google’s SEC filing (Feb 7, 2007).

- Co-founder Steve Chen’s stake (625,366 shares, plus 68,721 in trust) ended up worth $326.2M that day.

- Co-founder Jawed Karim’s stake (137,443 shares) was worth $64.6M that day.

- At least 24 YouTube employees received Google shares, with at least 2 becoming multi-millionaires — including YouTube’s spokeswoman, Julie Supan, who got 10,308 shares ($4.845M), and YouTube interface designer Christina Broadbeck, who got 18,898 shares ($8.882M)

- Several members of Steve Chen’s family and Chad Hurley’s family received shares, with the lowest value making them at least $3.23M richer, on paper.

Facebook’s Big Spenders

As indicated above, Facebook’s 2012 IPO minted two billionaires. It also created several millionaires.

- Facebook started trading on May 18, 2012, with an offering of approximately 421M (421,233,615) shares at an IPO price of $38.

- Co-founder and CEO Mark Zuckerberg owned 18.4% of shares (553.8M) before IPO, expecting to sell 30.2M shares to cover taxes. Pre-sale value, based on IPO price: about $21.044B.

- Edward Zuckerberg, the CEO’s father, had a stake worth an estimated $100M, based on IPO price.

- Co-founder Dustin Moskovitz owned about 4.9% of shares (nearly 134M) before IPO — worth about $5.092B based on the IPO price.

- Co-founder Eduardo Saverin gave up his American citizenship prior to the IPO to move to Singapore. He is currently a citizen of Brazil. His worth at the time, based on IPO price: about $4B.

- COO Cheryl Sandberg owned 1.9M shares (0.07%) before IPO — worth about $72M based on the IPO price.

- CFO David Ebersman owned 2.4M shares (0.09%) before IPO — worth about $91M.

- Sean Parker, co-founder of Napster.com, owned 69.7M shares before IPO — worth about $2.6B.

- Marc Andreesen, co-founder of Netscape, owned 0.2% of shares before IPO — worth about $251M based on the IPO price.

- Peter Thiel, co-founder of PayPal, owned 44.7M shares before IPO — worth about $1.7B based on the IPO price.

- Jim Breyer of Accel Partners owned 6% of shares (201.4M) before IPO — worth about $7.7B.

- Rock star Bono’s private equity firm, Elevation Partners, had a 1.5% claim in the company before IPO — worth nearly $1B.

- Twins Cameron and Tyler Winklevoss won a settlement against Facebook that made their collective ownership worth about $225M based on the IPO price.

- Graffiiti artist David Choe got shares worth at least $200M (as of May 16, 2012), just for painting murals at Facebook’s headquarters.

- Estimates suggest about 1,000 Facebook employees became millionaires on paper the day the company went public (subject to the whim of the market, given the company’s transient share price).

Twitter’s New Millionaires

What the Forbes list does not include is the new fortunes of Twitter billionaires, after the company’s IPO on Nov 7, 2013. Well, just one. While several people and investing companies became multimillionaires, only one person became a billionaire:

- Twitter started trading on Nov 7, 2013: 70M shares at an IPO share price of US$26, raising $1.82B.

- Co-founder Biz Stone is the only person to become a billionaire (on paper) as per an expected $29 share price by the time shares can be sold.

- Net worth based for all new Twitter millionaires is shown below, based the aforementioned $29 share price. Note: RSUs = Restricted Stock Units.

| Who | # shares | % ownership | Approximate value based on $29/ share |

| TOTAL: | 473,839,475 | ||

| Exec Officers/ Directors | |||

| Jack Dorsey, Executive Chairman, co-founder | 23,411,350 | 4.94 | $679M |

| Dick Costolo, CEO | 7,589,608 | 1.6 | $220M |

| Ev Williams, co-founder | 56,909,847 | 12.01 | $1,650M |

| Biz Stone, co-founder | unknown | ||

| Adam Bain | 1,722,350 | 0.36 | $50M |

| Peter Chemin, board member | unknown; RSUs | $3.7M (payout for role as board member) | |

| Peter Currie | 291,666 | 0.06 | $8.5M |

| Peter Fenton/ Benchmark Capital | 31,568,740 | 6.66 | $915.5M |

| David Rosenblatt | 283,333 | 0.06 | $8.2M |

| Series G holders (various) | 24,000,000 | 5.07 | $696M |

| Union Square Ventures | 24,000,000 | 5.07 | $696M |

| Noah Glass, co-founder | unknown | ||

| Christopher Fry, SVP Engineering | unknown; RSUs | ||

| Series C and D holders (Rizvi Traverse, Spark Capital) | 24,000,000 | 5.07 | $680M |

| MoPub | 14,791,464 | 3.12 | $429M |

American Millionaires

According to two Spectrem Group reports, estimates on new millionaires from all sources (tech, investment, etc.) in the United States for 2011 and 2012 are as follows:

2011:

- 200K new millionaires joined the ranks.

- 8.6M households had a total net worth NIPR (not including principal residence) of $1M or greater — down from the pre-recession high of 9.2M households in 2007 (a high mark for the years 1997-2011).

- 1.078M households had a net worth NIPR of $5M or greater.

- 107K households had a net worth NIPR of $25M or greater.

- 17% of 2011 millionaires were managers, followed by educators at 12%.

2012:

- Nearly 400K new millionaires joined the ranks.

- 8.99M households had a total net worth NIPR of $1M or greater — still down from 2007.

- The stock market’s rise accounts for most of this new wealth, with the top 10% of Americans owning over 80% of all stocks.

- 1.14M households had a net worth NIPR of $5M or greater.

- 117K households had a net worth NIPR of $25M or greater.

The wealth numbers for the years 1997-2012 are below. The figures in the net worth columns are the number of households in millions.

| Year | $500K+ Net Worth NIPR | $1M+ Net Worth NIPR | $5M+ Net Worth NIPR |

| 1997 | 10.9 | 5.3 | 0.23 |

| 1998 | 13.2 | 6.7 | 0.41 |

| 1999 | 13.7 | 7.1 | 0.59 |

| 2000 | 13.3 | 6.3 | 0.53 |

| 2001 | 9.6 | 6 | 0.48 |

| 2002 | 9.1 | 6.2 | 0.48 |

| 2003 | 10.5 | 6.2 | 0.54 |

| 2004 | 13.1 | 7.5 | 0.74 |

| 2005 | 14 | 8.3 | 0.93 |

| 2006 | 15.3 | 9 | 1.14 |

| 2007 | 15.7 | 9.2 | 1.16 |

| 2008 | 11.3 | 6.7 | 0.84 |

| 2009 | 12.7 | 7.8 | 0.98 |

| 2010 | 13.5 | 8.4 | 1.061 |

| 2011 | 13.8 | 8.6 | 1.078 |

| 2012 | 14.8 | 8.99 | 1.14 |

References:

Information for this article was collected from the following pages and websites:

- http://abcnews.go.com/Technology/facebook-millionaires/story?id=15499090#1

- http://www.cnbc.com/id/100552951

- http://www.businessinsider.com/twitters-ipo-will-make-all-these-people-millionaires-2013-10?op=1

- http://dealbook.nytimes.com/2009/08/19/googles-ipo-5-years-later/

- http://www.forbes.com/billionaires/list/

- http://www.forbes.com/sites/briansolomon/2013/03/04/the-worlds-youngest-billionaires-23-under-40/

- http://www.sec.gov/Archives/edgar/data/1418091/000119312513390321/d564001ds1.htm#toc564001_17

- http://www.secinfo.com/d14D5a.uM1t.htm

- http://spectrem.com/Content/AffluentMarketSize.aspx

- http://blogs.wsj.com/wealth/2012/03/21/millionaire-population-grows-by-200000/?Mod=WSJ_blogs_mostpop_read

Tips from Warren Buffet: