Find Your Perfect Business Degree

www.business-management-degree.net is an advertising-supported site. Featured or trusted partner programs and all school search, finder, or match results are for schools that compensate us. This compensation does not influence our school rankings, resource guides, or other editorially-independent information published on this site.

If you are interested in capital planning, investments, financial analysis, and all things related to finances and their impact on the global economy, a bachelor’s degree in Finance may suit you.

An undergraduate degree in Finance provides professionals with a comprehensive understanding of financial management and other finance-related aspects of an organization. The Bureau of Labor Statistics reports that Financial Analysts’ average earning is $96,220 per year.

Finance is one of the most profitable areas of business and opens a lot of career opportunities in the rapidly changing world. With the rising demand for finance professionals, this undergraduate degree fills up several positions in the financial sector.

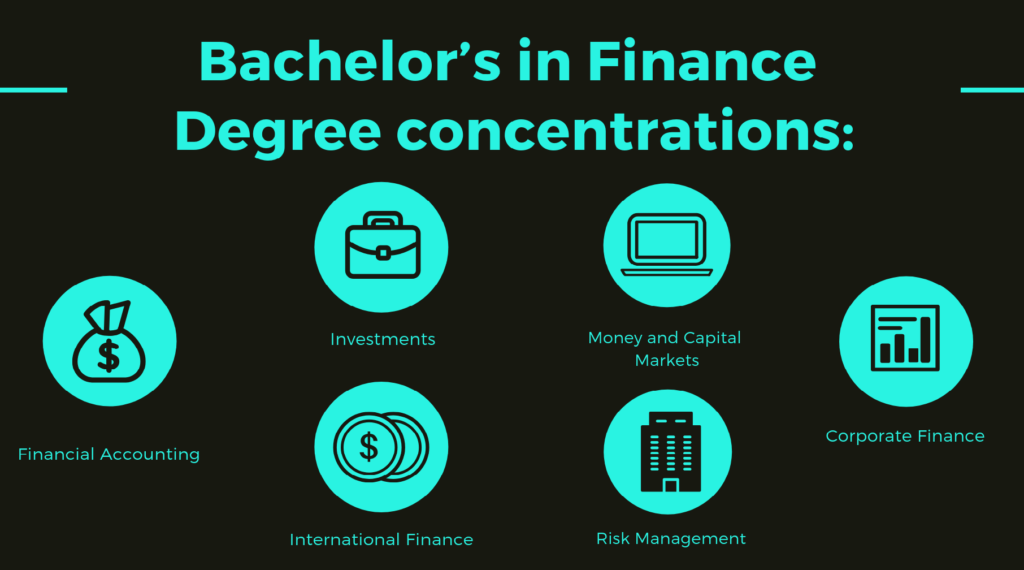

Students can pick their concentration with:

- Financial Accounting,

- International Finance,

- Investments,

- Risk Management,

- Money and Capital Markets,

- and Corporate Finance as choices.

Methodology

Our Best Online Schools for Bachelor’s in Finance Degree Programs present the academic institutions that were selected based on factors that put them ahead of other online programs. In developing this list, we highlighted these carefully selected programs, all of which have their unique strengths.

These online schools are in a league of their own nature, owing to their comprehensive coursework, rigorous and extensive curriculum, 100% online availability and support, a variety of financial aid opportunities, and excellent quality of education that gives students more than just classroom experience.

These online Bachelor’s in Finance degree programs have been accredited by globally recognized accrediting bodies, demonstrating that their instructional approach and coursework are at par with the best standards. By being enrolled in these schools, students can be sure about obtaining the knowledge and skills needed to excel in the workplace and meet the demands of their job.

Best Online Schools for Bachelor’s in Finance Degree Programs

PENNSYLVANIA STATE UNIVERSITY

Prominent Program Features: PennState World Campus offers a Bachelor of Science in Finance that helps students learn the conceptual skills essential to add value to finance-related fields.

This online finance program is offered in collaboration with Penn State Erie’s Behrend Campus and has been accepted into the CFA Institute University Affiliation Program, a status provided to educational institutions whose finance programs integrate a significant aspect of the CFA Program Candidate Body of Knowledge (CBOK) into the curriculum.

This 120-credit AACSB-accredited Finance degree develops a strong background in the principles and theories of Finance which includes investment and portfolio management, personal finance, and capital management.

Campus Location: University Park, Pennsylvania

Accreditation: Pennsylvania State University is accredited by the Middle States Commission on Higher Education

Types of Aid:

- Federal Student Loans, and Private Loans

- Tuition Assistance for the Unemployed (Trade Adjustment Assistance Program)

- Military and Veteran Benefits

- Federal, and State Grants

- Penn State Scholarships, and World Campus Student Fund; External Scholarships

Admission Requirements:

- Online Admission Application

- $65 Non-refundable Application Fee

- High School Transcripts or GED Transcripts

- Official Transcript of Records (For transferees), and Military Transcripts (If applicable)

- English Proficiency Examination (For international students)

Sampling of Coursework:

- Financial and Managerial Accounting for Decision Making

- Corporation Finance

- International Finance

- Supply Chain Management

- Strategic Management and Business Policy

The Final Result:

Graduates of PennState’s AACSB-accredited online finance program are prepared to pursue a career in corporate finance, banking, personal financial planning, and security analysis. They are expected to excel in the CFA Examinations.

The set of coursework is specifically designed to provide a firm grounding in the principles of accounting, business, and economics with an in-depth focus on the study and knowledge of financial management and other finance-related fundamentals.

LEARN MORE ABOUT PENNSYLVANIA STATE UNIVERSITY’S ONLINE BACHELOR IN FINANCE.

FLORIDA INTERNATIONAL UNIVERSITY

Prominent Program Features: The Bachelor of Business Administration in Finance is offered by FIU through the university’s R. Kirk Landon Undergraduate School of Business.

This fully online finance degree program helps students learn the latest technology in the field of finance, and develops their capabilities to gather and analyze pieces of financial information effectively and coherently.

Additionally, this program provides a strong foundation in the techniques of money management. Every distance learner is paired with a success coach. This 120-credit hour online program helps students enhance their analytical and managerial skills which are important to any business or finance-related career.

Campus Location: Miami, Florida

Accreditation: Florida International University receives accreditation from the Southern Association of Colleges and Schools Commission on Colleges.

Types of Aid:

- Grants

- Internal and External Scholarships

- Federal, and Private Loan Funds

- Federal Work-Study Programs

- Funds for Books through Book Advance

- Military and Veteran Benefits

Admission Requirements:

- Online Application for Admission

- $30 Application Fee

- Official High School Transcript of Records

- Official ACT or SAT Scores

Sampling of Coursework:

- Accounting for Decisions

- Statistics for Business and Economics

- Introduction to Information Systems Management

- Financial Management

- Introduction to Marketing

- International Financial Management

The Final Result:

Graduates of FIU’s online finance degree program can identify the functions and roles of financial markets and institutions and study the impact on the level of interest. They are equipped with the tools, capabilities, and critical-thinking skills that will help them pursue or advance professional careers in finance or post-graduate education in all areas of finance and business.

They also have solid practical and theoretical knowledge in several areas of finance, including portfolio management, financial engineering, investments, financial risk management, and financial institutions and markets.

LEARN MORE ABOUT FLORIDA INTERNATIONAL UNIVERSITY’S ONLINE BACHELOR OF BUSINESS ADMINISTRATION IN FINANCE.

THOMAS EDISON STATE UNIVERSITY

Prominent Program Features: Thomas Edison State University offers a Bachelor of Science in Business Administration in Finance that emphasizes three major topics namely Financial Management of Organizations, Investments, and Financial Market and Institutions.

This study of Finance is designed for students who are employed or plan to pursue a career in banking, in financial services industries, stock brokerage firms, and the financial department of major organizations.

This online finance program is offered in a flexible format, with new terms each month. TESU provides a set of courses in three different formats that will suit the students’ preferences namely Online, Guided Study, and Contract Learning. Also, the university awards students credit for military experience, professional experience, certifications, training, and licensure examinations.

Campus Location: Trenton, New Jersey

Accreditation: Thomas Edison State University has earned regional accreditation from the Middle States Commission on Higher Education.

Types of Aid:

- Internal and External Scholarships

- Pell Grants, Federal Education Loans

- State Grants, and Loan Programs

- Military and Veteran Benefits

- Comprehensive Tuition Plan

Admission Requirements:

- Online Application for Admission

- $75 Non-Refundable Application Fee

- Official High School Transcript of Records

- Transfer Credits from regionally-accredited schools

- Military and Professional Training (If applicable)

- DSST Scores, or CLEP Scores

Sampling of Coursework:

- Financial Accounting

- Principles of Management

- Business in Society or International Management

- Macroeconomics and Microeconomics

- Principles of Finance

The Final Result:

Graduates of TESU’s Bachelor of Science in Business Administration-Finance are prepared for a variety of rewarding careers in the accounting, business, and finance-related sectors. With the coursework that is geared towards working professionals, graduates pursue or make further advancements in their careers in stock brokerage, financial services industries, banking, and financial management organizations.

LEARN MORE ABOUT THOMAS EDISON STATE UNIVERSITY’S ONLINE BACHELOR OF SCIENCE IN BUSINESS ADMINISTRATION IN FINANCE.

SOUTHERN NEW HAMPSHIRE UNIVERSITY

Prominent Program Features: The Bachelor of Science in Finance offered by Southern New Hampshire University provides students with a set of skills to be able to establish a career in the multidimensional business marketplace.

Students develop firsthand expertise by handling a virtual stock market profile and designing and modeling with state-of-the-art technology to manage theories with applied knowledge in the field of finance.

This 120-credit hour online finance program is grounded in core business and finance knowledge which focuses on collaboration, communication, global orientation, personal and community responsibility, and entrepreneurial thinking.

SNHU offers an accelerated BS-to-MS pathway of learning for this online degree program. Students may specialize their skills through the CFP Board-registered program – B.S. in Finance – Financial Planning degree.

Campus Location: Manchester, New Hampshire

Accreditation: Southern New Hampshire University has earned regional accreditation from the New England Association of Schools and Colleges

Types of Aid:

- Federal and Private Loan Programs

- Federal and State Grants

- Institutional, Internal, and Outside Scholarship Programs

- Military and Veteran Benefits

- Federal Work-Study Programs

- Advantage Programs

Admission Requirements:

- Online Application for Admission

- Official Transcript of Records from schools attended

- Electronic Attestation Form

Sampling of Coursework:

- Corporate Finance

- Fundamentals of Investments

- Financial Markets

- Multinational Corporate Finance

- Financial Regulations and Ethics

The Final Result:

Graduates are prepared for entry to mid-level finance positions in several finance-related industries or investment firms in a globally-competitive and dynamic business world. They explore opportunities for corporate social stewardship, innovation, and sustainability.

They analyze local and global economic settings in support of growth and progression. Additionally, graduates apply ethical and analytical thinking skills that help them in principled decision-making strategies.

LEARN MORE ABOUT SOUTHERN NEW HAMPSHIRE UNIVERSITY’S ONLINE BACHELOR OF SCIENCE IN FINANCE.

WALDEN UNIVERSITY

Prominent Program Features: Walden University has a Bachelor of Science in Business Administration-Finance that helps students gain practical knowledge and relevant skills in numerous roles, industries, and sectors. The university prepares students to adequately assess and manage the financial aspects and operations of an organization.

The set of coursework under this online finance program equips the students on how key financial levers of industry work and operate as well as help them how the management direct the industry or organization to maximize its value to their employers and shareholders.

Walden’s rigorous finance program requires 181 total credit hours that comprise general education courses, business courses, concentration courses, elective courses, and a capstone.

Campus Location: Minneapolis, Minnesota

Accreditation: Walden University has garnered accreditation from the Higher Learning Commission.

Types of Aid:

- Federal, and State Loan Programs

- 10% Tuition Reduction for New Students residing in the U.S.

- Book Vouchers

- Federal, and State Grants

- Internal, and Outside Scholarship Programs

- Military and Veteran Benefits

Admission Requirements:

- Online Application for Admission

- Official High School Transcript of Records

Sampling of Coursework:

- Financial Management

- Fundamentals of Accounting

- Data Science Essentials

- International Finance

- Financial Institutions and Markets

- Corporate Finance

- Personal and Organizational Leadership

- Information Systems in Enterprise

The Final Result:

B.S.B.A in Finance graduates of Walden University are equipped with a strong background in a variety of finance-related capabilities. Graduates learn the basics of financial concepts and theories and gain tools that are essential to make long-term and short-term financial decision-making strategies.

Walden University provides employment and career placement opportunities for its graduates. Students are highly-trained in business communication skills in both written and non-written forms, making them competitive candidates in the finance industry.

LEARN MORE ABOUT WALDEN UNIVERSITY’S ONLINE B.S.B.A IN FINANCE.

LIBERTY UNIVERSITY

Prominent Program Features: The Bachelor of Science in Business Administration-Finance at Liberty University is recognized by the Accreditation Council for Business Schools & Programs (ACBSP). The university believes in quality education and helps its students achieve academic success in their endeavors.

This degree program is taught by professors who have real-world experience in the business and finance industries which allows them to apply the knowledge and learning and teach their students the practical skills to help them reach their goals.

Students learn analytical and critical thinking skills to make strategic financial decisions before entering the workforce. Also, students who are enrolled in this 120-credit degree program can access a wide variety of learning resources through Liberty’s research portal.

Campus Location: Lynchburg, Virginia

Accreditation: Liberty University garnered accreditation from the Southern Association of Colleges and Schools Commission on Colleges.

Types of Aid:

- Federal and State Grants

- Federal and Private Loan Programs

- Institutional and Outside Scholarships

- Book Vouchers

- Federal Work-Study Programs

- Deferred Corporate Tuition Assistance

- Interest-free Monthly Payment Plans

Admission Requirements:

- Admission Application

- $50 Non-Refundable Application Fee

- Unofficial College Transcript of Records with an Official Transcript Request Form

- High School Self-Certification Form

- Proof of English Proficiency

Sampling of Coursework:

- Financial Accounting

- Strategic Planning/Business Policy

- Principles of Management

- Corporate Finance

- Business and Economic Forecasting

The Final Result:

Graduates from Liberty University’s online finance degree program are prepared to venture in a variety of rewarding careers as investment bankers, loan officers, management consultants, real estate agent/brokers, entrepreneurs, or financial analysts. They are introduced with the essential practices and theories, so they are prepared to meet the challenges of a career in the finance-related industries.

Graduates develop decision-making skills that give them a competitive edge in the marketplace and add significance to their professional endeavors.

LEARN MORE ABOUT LIBERTY UNIVERSITY’S ONLINE BACHELOR OF SCIENCE IN BUSINESS ADMINISTRATION – FINANCE.

METROPOLITAN STATE UNIVERSITY

Prominent Program Features: The Bachelor of Science in Finance program provides a solid academic background in financing and risk management and investments.

It is designed to help students gain competence in financial application and theory as well as enhance their communication, critical thinking and quantitative capabilities. They study the different tools and applications involved in Finance, including concepts from economics, mathematics, statistics, accounting to deliberate financial decision making.

The program can be completed 100% online or by a combination of on-campus and online courses. The medium of instructions and quality is the same regardless of the delivery method. A capstone project is required to demonstrate the applied knowledge the students learn throughout the program.

Campus Location: Saint Paul, Minnesota

Accreditation: Metropolitan State University earn accreditation from the Higher Learning Commission.

Types of Aid:

- Metropolitan State University Foundation Scholarships

- University and External Scholarships and Grants

- Federal Work Study Program

- Federal and Private Loan Programs

- Military and Veteran Benefits

Admission Requirements:

- Online Application for Admission

- GED Transcript with Test Scores

- ACT, SAT or PSAT Scores

- GPA of 3.0 or higher

Sampling of Coursework:

- Investments and Portfolio Analysis

- Macroeconomics and Microeconomics

- Introduction to Operations Management

- Corporate Finance

- Financial Accounting

The Final Result:

Students who earn this finance degree offered by Metropolitan State University are well-prepared for a promising career in financial institutions, personal investment services, and corporate finance. They will be able to apply financial theories and concepts to carry out analyses to provide a means of support to corporate finance and business decision-making.

Moreover, they will effectively price financial assets such as bonds, stocks, and derivatives as well as design portfolios of investments.

LEARN MORE ABOUT METROPOLITAN STATE UNIVERSITY’S ONLINE B.S. IN FINANCE DEGREE PROGRAM.

UNIVERSITY OF HOUSTON CLEAR LAKE

Prominent Program Features: The College of Business of UHCL provides an affordable Bachelor of Science in General Business degree that provides students hands-on experience through numerous projects while developing a strong sense of ethical awareness and global perspective. The university provides comprehensive training and essential preparation to excel as a financial expert or leader.

This program is among the notable group of universities and colleges that received accreditation from the Association to Advance Collegiate Schools of Business. It is taught by a team of finance faculty members that have Ph.D.’s and come from top-notch business and industries, integrating the first-hand experience to every student in their methods of teaching.

Campus Location: Houston, Texas

Accreditation: University of Houston Clear Lake has earned regional accreditation from the Southern Association of Colleges and Schools Commission on Colleges.

Types of Aid:

- Federal and State Grants

- Federal and Private Loans

- Federal Work- Study Programs (FWS)

- Installment Plan and Short-Term Loan

- Military and Veteran Benefits

Admission Requirements:

- Online Application

- $45 Non-Refundable Application Fee

- High School Official Transcript of Records

- Official SAT or ACT Scores

- 11th Grade TAKS or STARR Test Scores

Sampling of Coursework:

- Principles of Accounting I and II

- Intermediate Accounting I and II

- Structure of Financial Statements

- Real Estate Investment Analysis

- Advanced Financial Accounting

The Final Result:

A UHCL graduate with a B.S. in Finance degree will have the mastery of skills in money management, corporate finance, investment banking, commercial banking, and real estate investments. Moreover, they are equipped with strong and effective communication skills essential in the operations of the business in the finance sector.

They are prepared to increase their professional value or continue in post-graduate studies. With the demand for more professionals in the finance sector growing, graduates from UHCL are equipped to fill the gap.

LEARN MORE ABOUT THE UNIVERSITY OF HOUSTON CLEAR LAKE’S ONLINE B.S. IN GENERAL BUSINESS DEGREE PROGRAM.

UNIVERSITY OF ALABAMA AT BIRMINGHAM

Prominent Program Features: The Bachelor of Science in Finance is offered by the University of Alabama at Birmingham through their Collat School of Business. It is a rigorous program that discusses essential finance-related topics such as:

- portfolio management,

- real estate investment and analysis,

- and financial analysis.

It equips students with a strong combination of problem-solving mindset, analytical skills, and critical thinking skills as well as social perceptiveness.

The university provides relevant and applied knowledge through an innovative curriculum, and state-of-the-art instructional methods to help students in their academic journey. Additionally, this online finance degree program is taught by finance professionals from multinational organizations or even startups. UAB is accredited by the AACSB, assuring students of top-quality education.

Campus Location: Birmingham, Alabama

Accreditation: The University of Alabama at Birmingham has received accreditation from the Southern Association of Colleges and Schools Commission on Colleges.

Types of Aid:

- Federal and Educational Loans

- Federal and State Grants

- Federal Work-Study Programs

- Institutional, Regional, and National Scholarships

- External Scholarship Programs Outside of UAB

- Veterans Scholarships

- Military and Veterans Benefits

Admission Requirements:

- Online UAB Application for Admission

- $30 Non-Refundable Application Fee

- Official High School Transcript of Records

- Official SAT or ACT scores

Sampling of Coursework:

- Financial Accounting

- Principles of Real Estate

- Fundamentals of Financial Management

- Equity Portfolio Management

- Intermediate Financial Management

The Final Result:

University of Alabama graduates are provided with limitless job opportunities and professional career pathways. With an AACSB-accredited degree, graduates are ensured of quality and notable education, offering them a competitive edge in the global marketplace.

UAB has several partnerships and collaborations with reputable private companies and government sectors which help students secure their careers.

LEARN MORE ABOUT THE UNIVERSITY OF ALABAMA AT BIRMINGHAM’S ONLINE BACHELOR OF SCIENCE IN FINANCE.

UNIVERSITY OF MARYLAND UNIVERSITY COLLEGE

Prominent Program Features: The award-winning Bachelor of Science in Finance by the University of Maryland University of College is specially designed to develop students’ expertise to apply finance methodologies and theories to real-world situations.

The program highlights a strong foundation in the concepts and aspects of accounting, economics, and business with an emphasis on the details of financial management and finance via intensive case studies.

The Bachelor of Science in Finance is designed to prepare students in specific industry certifications such as Certified Financial Planner, and Certified Management Accountant. Furthermore, students gain the analytical and critical thinking skills as well as the applied knowledge they need to join in the growing and competitive finance-related or business-related fields.

Campus Location: Adelphi, Maryland

Accreditation: University of Maryland University College is accredited by the New England Association of Schools and Colleges.

Types of Aid:

- Federal and State Grants

- Federal and State Loan Programs

- Institutional and Academic Scholarship Programs

- External Scholarships (Outside UMUC Scholarships)

- Interest-free Monthly Payment Plans

- Military and Veterans Benefits

Admission Requirements:

- Online Application for Admission

- $50 Non-Refundable Application Fee

- A passing score of the General Education Development (GED) Examination

- Official High School Transcript of Records

Sampling of Coursework:

- Principles of Accounting I and II

- Management and Organization Theory

- Financial Management

- Business Finance

- Security Analysis and Valuation

The Final Result:

Graduates from UMUC’s online finance degree program are prepared for professional career endeavors in corporate and government financial management, financial planning, contract management, portfolio analysis and management, banking, insurance, risk management, and investments.

They are trained to communicate, collaborate, and lead across the organization to reach the organizational goals ethically and effectively. Also, graduates utilize market principles, methodologies, and concepts as well as entrepreneurial skills to identify, develop, and manage business opportunities and networks for financial products and services.

LEARN MORE ABOUT THE UNIVERSITY OF MARYLAND UNIVERSITY COLLEGE’S ONLINE BACHELOR OF SCIENCE IN FINANCE.

DESALES UNIVERSITY

Prominent Program Features: DeSales University’s Bachelor of Science in Finance is suitable for students who have career aspirations in the pursuit of banking, security analysis, insurance, or financial management positions.

This finance program is offered in an accelerated format as well as it can be obtained conveniently 100% online. It will equip students with analytical building skills in accounting and economics that will help them meet industry growth and prepare them for a successful career.

The university receives global accreditation from the ACBSP for their online finance program, providing students the concrete basis of quality and credibility of the program they will enroll. DeSales offers certification examinations in Financial Planning (CFP) and Financial Management for interested applicants.

Campus Location: Center Valley, Pennsylvania

Accreditation: DeSales University garnered regional accreditation from the Middle States Commission on Higher Education.

Types of Aid:

- Federal and State Grants

- Federal and Private Loans

- Institutional and Academic Scholarships

- Student Employment Programs

- Military and Veterans Benefits

Admission Requirements:

- Online Admission Application

- Official High School Transcript of Records

- SAT or ACT Test Scores

- One Guidance Counselor Form, and One Teacher Recommendation Form

Sampling of Coursework:

- Managerial Accounting

- Financial Planning Development

- Sales and Sales Management

- Financial Management

- International Business

The Final Result:

Graduates from DeSales University’s B.S. in Finance will be able to understand and provide demonstrations regarding the functionality and features of equity markets and debts. They evaluate personal or business decisions using financial aspects such as free cash flows, net present value, and average costs of capital.

Furthermore, graduates can explain the role of money in the changing economy including strong knowledge of the foreign exchange, interest rates, functions of banks, and capital and money markets.

LEARN MORE ABOUT DESALES UNIVERSITY’S ONLINE BACHELOR OF SCIENCE IN FINANCE DEGREE PROGRAM.

DAVENPORT UNIVERSITY

Prominent Program Features: Davenport University offers a Bachelor of Business Administration in Finance that prepares students to be an effective financial manager and allows them to drive financial decision making most effectively and ethically.

Moreover, this 120-credit hour online finance degree program has been designed as a collaboration with the business community to deliver a relevant, rigorous curriculum. Students develop a broad sense of knowledge in international business, budgeting, internal controls, investments, and data analysis.

The Bachelor of Finance is also offered with a Financial Planning concentration for individuals who want to become financial advisors to people or business. This program has been recognized by the Certified Financial Planner Board of Standards Inc., providing the students with the eligibility to take the Certified Financial Planner (CFP) without the tedious application process that non-registered program students must complete.

Campus Location: Grand Rapids, Michigan

Accreditation: Davenport University is accredited by the Higher Learning Commission.

Types of Aid:

- Federal Grants

- State Grants and Scholarships

- External Scholarships

- Davenport Foundation Scholarships

- Davenport Institutional Scholarships

- Military and Veteran Benefits

Admission Requirements:

- Application for Admission

- High School Official Transcript of Records or GED

- ACT and SAT Scores

Sampling of Coursework:

- Accounting Foundations I and II

- Corporate Finance

- Management Foundations

- Federal Taxation I

- Financial Analysis for Business Managers

The Final Result:

Graduates from Davenport’s exceptional degree program will make contenders for in-demand positions such as controller, risk analyst, certified financial planner, chief financial officer, business services manager, and financial analyst. They are equipped with an in-depth focus on credit analysis for the ability to analyze the strengths and weaknesses of an organization’s financials.

LEARN MORE ABOUT DAVENPORT UNIVERSITY’S ONLINE B.B.A IN FINANCE DEGREE PROGRAM.

GRANITE STATE COLLEGE

Prominent Program Features: Granite State College’s Bachelor of Science in Accounting and Finance is a blended program of the Accounting and Finance essentials with management and organizational processes that students use on employment. Students will learn how to plan financial budgeting, manage investments, help organizations maximize financial assets, and gain efficiencies.

With the blended study, students who have a goal to become Certified Public Accountants will acquire the essential skills and knowledge. A team of faculty members who are subject matter experts will help students learn through their shared real-world experiences in the industries.

Career counseling is made available to students and alumni, making them one of the top-ranked educational institutions for their online bachelor’s degree programs by the U.S. News & World Report.

Campus Location: Concord, New Hampshire

Accreditation: Granite State College has received accreditation from the New England Association of Schools and Colleges.

Types of Aid:

- Federal and State Grants

- Student Loans

- Scholarships and Grants

- Federal Work-Study Programs

- Tuition Waivers and Discounts

- Military and Veteran Benefits

Admission Requirements:

- Online Application for Admission

- High School Official Transcript of Records

- ACT or SAT Test Scores

Sampling of Coursework:

- Intermediate Accounting I and II

- Principles of Management or Organizational Behavior

- Cost Accounting

- Financial Management

- Investment Principles

- Accounting Information Systems

The Final Result:

Graduates made a practical and relevant choice in taking the Accounting and Finance degree since these services are essential to government sectors, corporations, individuals, and charities. Certified Public Accountants (CPA) have favorable job prospects through their earned professional credentials.

Graduates who are interested in the Finance aspect will land in trade, international, or investment markets and stay on top of emerging financial products and services that present new investment opportunities. They demonstrate the knowledge and concepts of essentials in the accounting and finance fields to offer sound information through reliable processes to the accounting and financial services.

LEARN MORE ABOUT GRANITE STATE COLLEGE’S ONLINE B.S. IN ACCOUNTING AND FINANCE DEGREE PROGRAM.

UNIVERSITY OF MINNESOTA CROOKSTON

Prominent Program Features: The degree in Finance offered by the University of Minnesota Crookston is specially designed to provide students with an analytical framework as well as theoretical aspects required to work ethically and effectively in financial institutions.

Considered as one of the most comprehensive public universities and one of the most reputable in the country, the University of Minnesota offers high-quality and state-of-the-art teaching, learning, and research fundamentals as well as extensive internship and undergraduate research opportunities. Their online faculty is a team of professionals who earn Ph.D.’s with real-world expertise and experience in the industries.

As a result, they share their learning and knowledge with their students to help them achieve their goals and academic excellence. The university offers this online finance program in small class sizes and individualized attentiveness.

Campus Location: Crookston, Minnesota

Accreditation: The University of Minnesota Crookston has earned accreditation from the Higher Learning Commission.

Types of Aid:

- Federal and Institutional Scholarships

- Federal and State Grants and Waivers

- Federal and Private Loans

- Federal Work-Study and Study Employment Programs

- Military and Veteran Benefits

Admission Requirements:

- Application for Admission

- Official High School Transcript of Records

- ACT or SAT Test Scores

- Official College Transcript of Records for College Credits Earned

Sampling of Coursework:

- Income Tax I and II

- Principles of Accounting I and II

- Insurance and Risk Management

- Money, Banking and Financial Institutions

- Corporate Finance

The Final Result:

Graduates of the program can understand the dimensions of risk and implementation relevant to financial services organizations. They are able to assess consumer financial aspects and the theories available for fulfilling the financial needs of the business.

As a result, they are employed in job opportunities in many banking and finance institutions including personal financial planning, government agencies, corporate and international financial management, investment services, risk and insurance industries, and commercial and investment banking.

LEARN MORE ABOUT THE UNIVERSITY OF MINNESOTA CROOKSTON’S ONLINE BACHELOR OF SCIENCE IN FINANCE DEGREE PROGRAM.

FRANKLIN UNIVERSITY

Prominent Program Features: Franklin University’s Bachelor of Science in Financial Management teaches students how to analyze an organization’s financial performance and stable financial health. They develop and acquire in-demand comprehension and skills in:

- portfolio management,

- financial risk management,

- financial analysis,

- cash management,

- financial forecasting,

- and international finance.

The Financial Management major receives accreditation from the International Accreditation Council for Business Education (IACBE), so students will know they are earning a reputable degree with value in their chosen workplace. The program is taught by real-world practitioners who will help students achieve their academic success and excellence through shared best practices and experiences.

Campus Location: Columbus, Ohio

Accreditation: Franklin University earned accreditation from the Higher Learning Commission.

Types of Aid:

- Federal and State Aid

- Institutional and External Scholarship Programs

- Institutional Aid and Private Loans

- Installment Monthly Payments

- Deferred Tuition Reimbursement

- Direct Company Billing

- Military and Veteran Benefits

Admission Requirements:

- Application for Admission

- High School Transcripts

Sampling of Coursework:

- Financial Accounting

- Marketing

- Managerial Accounting

- Principles of Management

- Business Law

- Principles of Finance

- Introduction to Microeconomics

- Advanced Financial Management

- Money, Banking, and Financial Markets

The Final Result:

Graduates of Franklin’s Financial Management gain in-demand skills sought by employers across several financial industries. They learn from five major concentrations on the curriculum namely Financial Risk Management, Financial Analysis & Forecasting, International Finance, Portfolio Management, and Cash Management.

They will have an excellent foundation to pursue post-graduate studies in business or law or make further advancements in their professional pathways in the financial services, business financial management, international finance, or investment management industries.

LEARN MORE ABOUT FRANKLIN UNIVERSITY’S ONLINE B.S. IN FINANCIAL MANAGEMENT.

BRANDMAN UNIVERSITY

Prominent Program Features: The Bachelor of Business Administration in Finance prepares students for new positions and career advancement opportunities in the global business market. They develop a strong foundation of business fundamentals as part of their core curriculum as well as taking online classes on topics such as:

- international finance,

- financial management,

- capital markets,

- and investments.

The curriculum is available entirely online or as a hybrid program in any eight campus locations throughout California and Washington.

Students will be able to have an in-depth appreciation for the critical role of maximizing the value of organizations or corporations, including risk analysis and investment strategies. Participants will comprehend the benefits of investments and will be able to validate the risks that every investor will face.

Campus Location: Irvine, California

Accreditation: Brandman University has received accreditation from the WSCUC Senior College and University Commission.

Types of Aid:

- Federal and State Aid

- Federal and Private Loans

- Military and Veteran Benefits

Admission Requirements:

- Completed Application for Admission

- Official Transcript of Records from all colleges and universities attended (If applicable)

- High School Official Transcript of Records

- Minimum GPA of 2.0 or higher

- 12 or more transfer credits from a baccalaureate level or equivalent (If applicable)

Sampling of Coursework:

- Principles of Accounting I and II

- Introduction to Computers and Data Processing

- Leadership in Diverse and Multicultural Organizations

- Legal Environment of Business

- Leadership and Professional Ethics

The Final Result:

Graduates will be competitive candidates for employment opportunities or careers as accountants, financial analysts, compliance officers, personal financial advisors, and other finance-related professions.

The coursework prepares graduates for extensive training for any certification or licensure examinations. Furthermore, they can pursue post-graduate studies in any business-related or finance-related field, or they can pursue advancement opportunities in their current or new professions.

LEARN MORE ABOUT BRANDMAN UNIVERSITY’S ONLINE BBA IN FINANCE DEGREE PROGRAM.

UNIVERSITY OF HOUSTON DOWNTOWN

Prominent Program Features: University of Houston Downtown’s Bachelor of Business Administration in Finance is offered by the university’s Marilyn Davies College of Business, ranking top 13 in the U.S. in terms of affordability and quality. This degree program prepares students to become world-class graduates in several finance-related industries such as:

- banking,

- financial management,

- financial institutions,

- and investment management.

The university aims to produce graduates who can support individuals and organizations to increase productivity through economic and technological resolutions.

This rigorous program prepares students to take licensure examinations such as Chartered Financial Planners (CFP), Chartered Financial Analysts (CFA), and Certified Treasury Professionals (CTP). Moreover, they provide 1:1 support for their students in their distance learning journey.

Campus Location: Houston, Texas

Accreditation: The University of Houston Downtown has been accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Types of Aid:

- Federal and State Grants

- Federal and Private Loans

- Federal Work-Study Programs

- Institutional and External Scholarship Programs

- Exemptions and Waivers

- Military and Veteran Benefits

Admission Requirements:

- Online Application for Admission

- Official High School Transcript of Records

- $50 Non-Refundable Application Fee

- Official SAT or ACT Test Scores

Sampling of Coursework:

- Financial Accounting

- Individual Income Tax

- Intermediate Accounting I and II

- Managerial Accounting

- Principles of Marketing

- Marketing Strategy

The Final Result:

As graduates of the Finance degree program offered by UHD, individuals are equipped with a set of skills that will help them establish their placement in a variety of career opportunities. They set themselves apart to succeed in the finance-related or business-related fields.

Graduates are prepared for a wide selection of promising careers including but are not limited to financial examiners, corporate finance managers, insurance agents, investment managers, financial service professionals, personal financial advisors, wealth managers, credit analysts, and security analysts.

LEARN MORE ABOUT THE UNIVERSITY OF HOUSTON DOWNTOWN’S ONLINE B.BA IN FINANCE DEGREE PROGRAM.

UNIVERSITY OF MASSACHUSETTS AMHERST

Prominent Program Features: The Isenberg School of Management of the University of Massachusetts Amherst offers a Bachelor of Business Administration with a Finance concentration program for individuals who want to advance in their current professions or make a career shift in the business-related industries. Students learn how corporations or organizations make key financial decisions.

The curriculum integrates rigorous training in applied knowledge with technical and real-world case studies. Students develop financial expertise by enrolling a series of coursework in:

- bank management,

- corporate finance,

- international finance,

- investments,

- advanced corporate finance,

- and financial modeling.

UMass delivers a flexible learning environment with an accredited education from the AACSB, ensuring students earn a reputable degree with value in the workplace.

Campus Location: Amherst, Massachusetts

Accreditation: The University of Massachusetts Amherst has garnered accreditation from the New England Commission of Higher Education.

Types of Aid:

- Federal and State Grants

- Federal and State Scholarships

- Federal and Private Loans

- Federal Work-Study Programs

- Military and Veteran Benefits

Admission Requirements:

- Online Application for Admission

- Minimum 27 Transferable Semester Credits

- Application Fee

- Official Transcript of Records

- Resume/CV

- 2-3 Page Personal Statement

Sampling of Coursework:

- Principles of Financial Accounting

- Corporate Finance

- Management Communications

- Business Data Analysis

- Principles of Managerial Accounting

- Introduction to Law

The Final Result:

Graduates apply their skills, knowledge, and learnings as financial managers, financial analysts, financial controllers, loan officers, financial planners, bank examiners, and other finance-related career opportunities in multinational and national corporations, insurance companies, real estate companies, and brokerage firms.

They are encouraged and well-supported by UMass to get involved in several industries and start professional networking. They are eligible to take licensure examinations and certifications through the Certified Financial Planner Board of Standards, Chartered Financial Analyst Institute, and the Chartered Alternative Investment Analyst Association.

LEARN MORE ABOUT THE UNIVERSITY OF MASSACHUSETTS AMHERST’S ONLINE BBA IN FINANCE DEGREE PROGRAM.

NORTHEASTERN UNIVERSITY

Prominent Program Features: Northeastern University’s Bachelor of Science in Finance and Accounting Management is designed to align students’ skills with the rapidly-growing professions in the field of finance and accounting fields.

It develops students’ understanding of how to interpret financial statements, create and manage financial budgets, measure and disclosure of significant financial metrics, and maximize investments.

This degree program receives superior accreditation from the AACSB in its curriculum that integrates accounting, economics, law, finance, globalization, technology, and sustainability as well as the impact of new forms and regulation in the financial and accounting industries.

A team of industry-aligned faculty members brings real-world expertise, knowledge, and experience that will help students achieve their professional goals and academic excellence.

Campus Location: Boston, Massachusetts

Accreditation: Northeastern University receives accreditation from the New England Association of Schools and Colleges.

Types of Aid:

- Federal and State Loans

- Federal and State Grants

- Institutional and External Scholarship Programs

- Employer Reimbursement

- Military and Veteran Benefits

Admission Requirements:

- Completed Online Application Form

- Official High School Transcript of Records, and Official GED

- English Language Proficiency Proof (For international students)

- Current Resume, References, and Statement of Purpose (Optional)

Sampling of Coursework:

- Introduction to Corporate Finance

- Financial Accounting

- Computer Applications

- Business Law

- Business Ethics

- Principles of Marketing

The Final Result:

Graduates of the Bachelor of Science in Finance and Accounting Management program have several career options to choose from finance- and accounting-related positions including loan officers, financial specialists, cost estimators, management analysts, revenue agents, bookkeepers, accountants, real estate assessors, tax examiners, financial advisors, and insurance underwriters.

Professionals with certifications or licensures such as Certified Public Accountants, Certified Financial Analysts, or Certified Management Accountants are likely to enjoy career opportunities with more advantages in the accounting and finance field.

LEARN MORE ABOUT NORTHEASTERN UNIVERSITY’S ONLINE B.S. IN FINANCE AND ACCOUNTING MANAGEMENT DEGREE PROGRAM.

NATIONAL UNIVERSITY

Prominent Program Features: National University is San Diego’s #1 largest private non-profit university and offers a Bachelor of Science in Financial Management with four-week classes.

Students gain practical and theoretical extensive training in financial decision-making and managing financial resources. They get hands-on learning experience in data analysis and learn strategies to advise the leadership of an organization on how to maximize profits and capital.

Furthermore, this program provides training in the latest advancements of technology to produce and manage financial reports, investment activities, and develop plans and strategies for the short-term and long-term financial goals of an organization. Faculty members provide real-world expertise, knowledge, and techniques to students to help them achieve their academic excellence and professional goals.

Campus Location: La Jolla, California

Accreditation: National University earns accreditation from the WASC Senior College and University Commission.

Types of Aid:

- Federal and State Grants

- Federal and State Scholarship Programs

- Federal and Private Loans

- Institutional and External Scholarship Opportunities

- Federal Work-Study Programs

- Military and Veteran Benefits

Admission Requirements:

- Online Application for Admission

- Enrollment Agreement Form

- High School Official Transcript of Records

- Minimum GPA of 2.0 or higher

Sampling of Coursework:

- Principles of Management and Organizations

- Principles of Macroeconomics and Microeconomics

- Financial Institutions

- Financial Accounting Fundamentals

- Working Capital Management

The Final Result:

Graduates can explain the financial objectives and principles of an organization and apply quantitative, qualitative, and critical thinking skills as well as problem-solving skills to achieve the goals and objectives of the company.

They discuss practical aspects of corporate finance in their chosen organizations. Moreover, graduates have a wide selection of professional pathways in investment, corporate banking, insurance, and other finance-related professions and industries.

LEARN MORE ABOUT NATIONAL UNIVERSITY’S ONLINE B.S. IN FINANCIAL MANAGEMENT DEGREE PROGRAM.

Frequently Asked Questions

What is the career outlook for Bachelor’s in Finance degree holders?

A graduate with a Bachelor of Science in Finance or a Bachelor of Business Administration in Finance degree can land numerous career opportunities and pursue many potential professional pathways. There is no shortage of demand for financial professionals in the industries, including in:

- banking and financial firms,

- brokerage,

- restaurants,

- hospitals,

- government sectors,

- academic institutions,

- insurance companies,

- or Fortune 500 companies.

With this, the finance industry is a rapidly growing industry whose demand for finance professionals will continue to rise in the next couple of years.

Undergraduate holders can pursue Finance’s popular career choices such as financial analysts, financial officers, personal financial advisors, insurance agents, budget analysts or officers, credit analysts, accountants, commercial real estate agents, or even professors in the university.

The job outlook for Finance majors, according to the Bureau of Labor Statistics, is 8% within the years 2022 and 2032. No doubt, the demands for financial professionals and financial regulators are quicker than the average for all occupations.

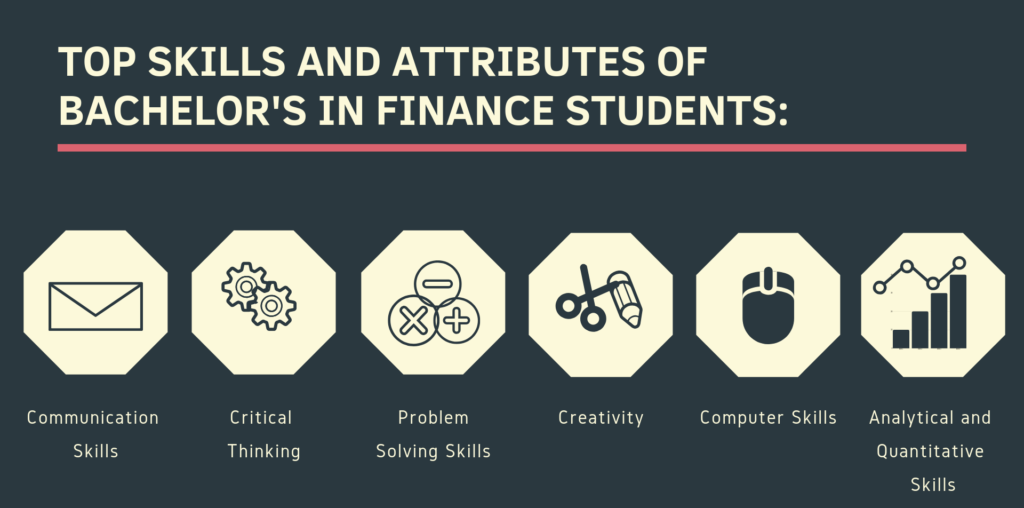

What skills can I expect to develop as a Bachelor’s in Finance degree student?

Studying Finance is a challenging yet rewarding endeavor, and when you are interested in pursuing a degree in Finance, it is essential to assess your set of skills and evaluate whether the degree is suitable for you.

Here are the most common skills you will need to develop as an undergraduate Finance student:

- Communication Skills – The ability to effectively communicate and relay information is crucial as you progress in your career in the finance industry. From time to time, you will be tasked to effectively communicate through complex data and pieces of information to show how various financial aspects of the organizations may be impacted.

- Problem-solving Skills – As a Finance major, you’ll be presented with different scenarios that need strategic financial decision-making abilities. Often, the company will ask for a financial professional’s expert advice on how to enhance, modify, maximize, and minimize the financial resources of an organization. You’ll need to evaluate what considerable actions can be taken, spot trends across the industries, and evaluate potential solutions and opportunities.

- Creativity – This skill is often overlooked in the field of Finance. However, this is a known skill among Finance majors who succeed in their chosen occupation. With this, you might be often asked to provide unique and innovative solutions to problems and implement them in unique ways.

- Microsoft Excel Skills or other Computer Applications – You will need to spend a significant amount of time learning the unique features and functions of Microsoft Excel which goes hand in hand with analyzing data. Working in finance involves putting together pieces of information and financial models that can be utilized to test a financial decision-making strategy or an investment strategy.

- Analytical and Quantitative Skills – Numbers and data propel the finance industry. If you have mathematics and statistics as your greatest strength, you will excel in finance studies. You will need solid analytical and mathematical skills when you need to comprehend and analyze data as well as link concepts and derive conclusions based on your data gathering or findings.

What accreditations do I need to consider in choosing a Bachelor’s in Finance degree?

Accreditation demonstrates that a school or university has met the standards of quality that are set by a reputable accrediting agency, with the commitment to not only meet these standards but also for continuous improvement and innovation of the quality of education or training provided by the educational institution.

There are three main accreditors for the finance-related programs namely:

- Association to Advance Collegiate Schools of Business (AACSB),

- International Assembly for Collegiate Business Education (IACBE),

- and the Accreditation Council for Business Schools and Programs (ACBSP).

Furthermore, institutional accreditation is provided by different regional and national associations of educational institutions such as The Higher Learning Commission. Also, there are six regional accrediting associations namely the Middle States, Western, Southern, North Central, New England, and Northwest.

Whether it is for traditional classrooms or distance learning, accredited educational institutions allow students to apply for financial aid.

Can I earn a Bachelor’s degree in Finance entirely online?

Yes, many institutions offer Bachelor’s degrees in Finance online. Online classes in Finance typically involve the same coursework as in-person classes but typically include a large online component such as assignments, group projects, and recordings of lectures or readings. Depending on the institution, students may also need to attend online lectures and meetings, or complete examinations and quizzes online.

Related Resources: